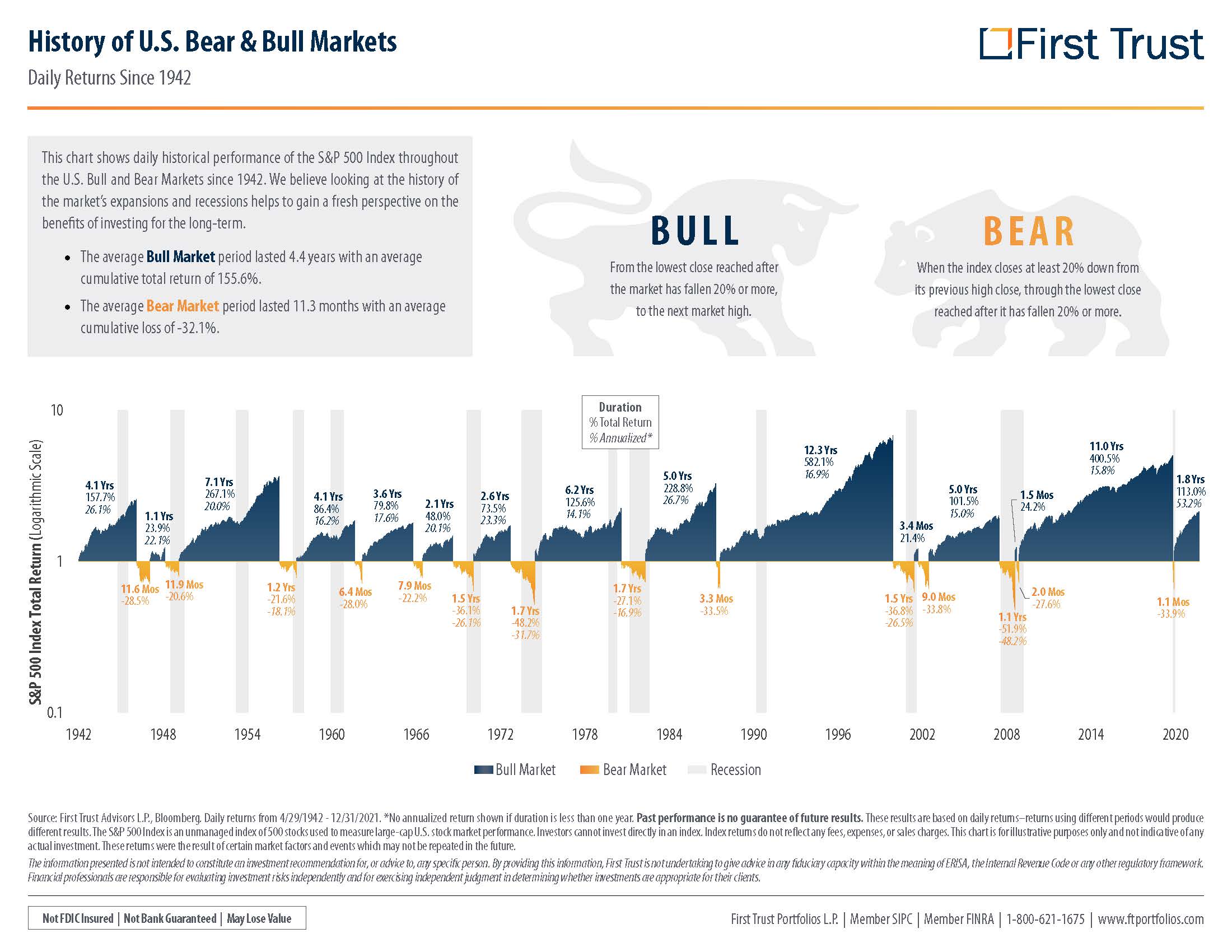

“Success seems to be largely a matter of hanging on, after others let go.” – William Feather Winners don’t quit the stock market. Period. Investors always win over the long term. It’s quite easy to see in the chart,...

We have talked a lot about financial wellbeing in our past blogs and how not to let our emotions derail our financial plan, yet FOMO (fear of missing out) is trending now and deserves our attention. Did someone ever...

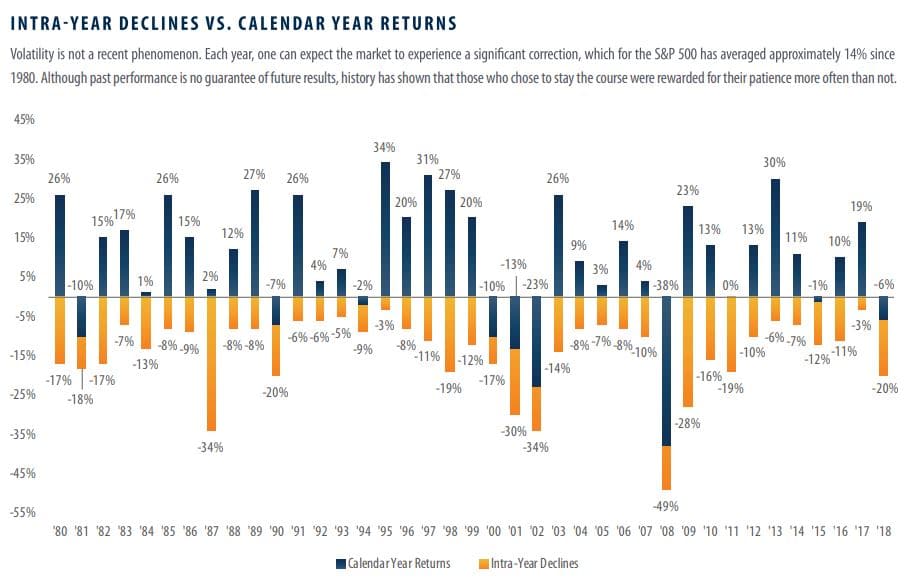

Staying the Course Investors tend to see short-term volatility as the enemy. Volatility may lead many investors to move money out of the market and “sit on the sidelines” until things “calm down.” Although this approach may appear to...

The last two months have brought continued market volatility to both stocks and bonds. It can be hard to stomach at times, yet it’s also expected. The long-term investor knows that markets on average, go up 7 out of...

Over the weekend, a relative asked, “Are we in a bear market?” I answered his question with, “What do you think a bear market is?” He rattled off a few comments about the economy, and the market being down...

You’ve seen the headlines, you’ve heard the talking heads, you likely have negative feelings when you see the term blasted across the front page of the business periodicals. Markets have been swinging wildly in 2018. Things started off great...

U.S. stocks are cresting to all-time highs, almost daily. These are the times when investors look forward to opening their monthly statement. The anticipation is high, you open the envelope (or electronic statement) and wow, is that right? Shouldn’t...

For shorter investment timelines, the safety of your money may be more important than the fact that the money keeps up with inflation. If so, there are a handful of investment options available, including . . .